Is there a way for novice traders to enter the cryptocurrency market? Is it possible for someone who does not have sufficient skills and knowledge in the field of blockchain technology, trading tools and market risks and can not take the time to learn them, to take advantage of investment opportunities? The answer is yes! Copy Trading is a tool that enables you to automatically copy and execute positions taken and managed by other people. In this article, we will discuss what copy trading is, how it is done, what are the advantages and disadvantages of copy trading, and finally, we will introduce and review several Copy Trading platforms. Stay with us.

What is Copy Trading?

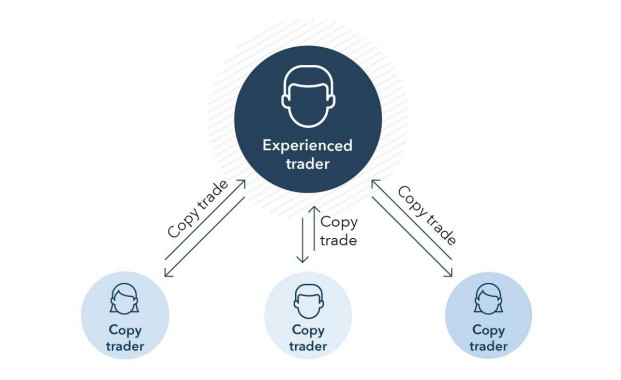

The term "copy trading" more or less explains its meaning; In Copy Trading, you choose a professional trader and then execute his behavior and strategies perfectly. For example, your trader buys 100 BNB, and you buy 100 BNB on his credit. Or he spends 5% of his portfolio investing in artificial assets, and you do the same. You may have heard of Social Trading or Mirror Trading before. Social Trading, Mirror Trading and Copy Trading are from the same root; Because in all of these trading methods, all you have to do is implement someone else's investment strategy exactly.

Performance of copy trading transactions

How to do copy trading in different digital currency exchanges is different, but they all have the same basic principles. On all of these platforms, affiliate traders can link a portion of their investment portfolio to a particular trader's account and copy his or her trades at a certain percentage. Most platforms do not allow affiliate traders to devote more than 20% of their capital to a copy of a professional trader; Because it can be very risky for them and it may be a professional trader in appearance better than the reality.

The main pillars of copy trading

As mentioned before, the way transactions and services are provided in different digital currency exchanges are different, but in principle they are the same. Here are some basic rules of copy trading:

Market: The market is one of the main pillars of copy trading. Obviously, a financial instrument will develop in the financial market. The market in which copy trading was first used was the Forex market, and with the birth of the CFD, other markets such as the stock market, indices, commodities, interest rates, ETFs and even bitcoins entered the field.

Trading platform brokers: Brokerage is one of the main elements of copy trading, in other words, without it, you can not invest in any market. In this type of trading, you need a broker to open the account to get the trades you want to copy. Of course, brokerages are not very useful in the world of digital currencies, and people can use the copy trading service without using a brokerage.

Principal Trader (Signal Provider): These are the same professional traders whose performance you select to copy trading. On any platform, novice traders can analyze and analyze the trading performance of a professional trader based on various data.

Investor (follower): The investor or follower is the person who seeks to use the copy trading method to earn money. Copy trading has a lot of flexibility and can be used in different markets.

Copy Trading Platform: It is not possible to use the Copy Trading service without a Copy Trading platform. There are different types of these platforms and novice traders can choose the best platform based on their expectations.

Examine how Copy Trading works

Copy trading depends more on their behavior than on the information and strategies provided by traders. As mentioned earlier, in the copy trading method you are copying the actions of other traders. For example, on Copy Trading platforms, when you select a trader, your portfolios or portfolios are linked together, and each position that the trader opens is automatically copied and executed from his account to your account. The copywriter can decide how much of his assets he wants to invest in the trading strategy; Although most platforms do not allow you to invest more than 20% of your portfolio this way.

For example, you have $ 2,000 in your account and you want to copy the strategy of a successful trader. If you are a beginner, it is better to invest only 10% of your assets, ie $ 200. Each platform has a different way of getting started. But in general, the process is as follows:

You log in to the account in the exchange you want and create an API; Application Programming Interface (API) is a set of protocols and tools for creating software. APIs determine how software components interact. For example, they specify what information to use and what to do.

Then you have to choose the trader or trading bot (Trading Bot) you want.

Next, you need to follow the trader or trading robot. The rest is done automatically.

icons at the top right corner of the subsection.

icons at the top right corner of the subsection.